تقرير حركة الذهب الأسبوعي – 14 يوليو 2025

التحليل الأساسي:

Gold prices continued their sideways movement last week and began to rise at the start of this week, driven by underlying strength pointing to a bullish bias.

Our research department still expects prices to move above the $3,500 level, possibly reaching $3,800. We also anticipate that the resistance zone around the repeated $3,430 level will loosen, which may push gold prices higher — though we might have to wait until after the FOMC meeting on July 30. This is because expectations for upcoming rate cuts are likely to become more decisive after that.

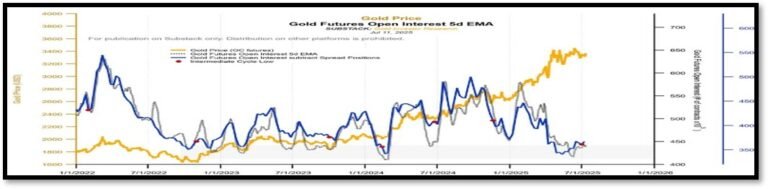

As for the COT (Commitments of Traders) report, not much has changed in this week’s CFTC data.

The long position share of Managed Money slightly declined to 45.4% of open interest, while its short position also dropped to 16.3%.

As for open gold futures contracts, they continue to trend upward and break out of their sideways pattern, which confirms the upcoming rise.

إخلاء المسئولية: نقدم جميع الأخبار والآراء والبيانات المالية وغيرها من خدمات انطلاقا من سياسة الشركة التي تهدف إلى خدمة العملاء غير مسئولين عن الخسائر نتيجة الاعتماد على المعلومات الواردة، يرجى أن تكونوا على علم تام بشأن مخاطر التداول في الأسواق المالية.

التحليل الفني:

Alongside some models pointing to gold targets above the $3,500 level, we have found the following:

The latest report from Apollo Global Management highlights a growing risk tied to the resumption of federal student loan repayments. With 45 million borrowers and 24% already delinquent, more than 11 million Americans may see their credit scores decline — limiting their ability to secure loans for essential purchases such as cars and appliances.

Default rates are rising sharply. For context, the subprime mortgage crisis triggered a systemic collapse with default rates below 10% — and now we’ve already crossed the 20% threshold.

So, what’s the difference now? Why hasn’t the market collapsed yet?

The government is absorbing this slow bleeding behind the scenes. The student loan system, once a key financial engine, is now effectively stagnant. Student debt represents 9% of total household liabilities and disproportionately affects the 30–59 age group — the main driver of consumer spending. A decline in creditworthiness within this group signals weakening demand across the broader economy.

ملحوظه:

At 8% default rates, the entire market could collapse.

The subprime mortgage collapse happened with less than 10%. Now, 24% is an alarming figure. Why hasn’t it triggered a collapse yet? Because the government is slowly absorbing the losses. The student loan sector is essentially finished, along with the silent support of higher education as an industry.

This may lead us to expect that the Federal Reserve could proceed with interest rate cuts in the coming period — and possibly another round of quantitative easing — because this situation poses a serious threat to the economy. In such a scenario, gold stands to benefit.

-

- ما زالت توقعاتنا طويلة الاجل تشير الى أحتمالية ارتفاع سعر الذهب الى مستويات 3700 وقد تصل الى مستويات 3800 وقد تصل الى مستويات 4000

-

- الفترة الزمنية التى يتوقعها قسم الابحاث لدينا هي من سيتمبر الى أكتوبر ...

-

-على المستوي قصير الاجل نتوقع الاتي:-

A rise toward the $3,430 level. We believe the most important support levels during the current week are $3,350 and the second at $3,335, from which we expect a move upward to $3,400. -

This outlook would be invalidated if the price closes below $3,300.

النقطة المحورية 3350

نقاط المقاومة 3400

Support Levels: 3350

إخلاء المسئولية: نقدم جميع الأخبار والآراء والبيانات المالية وغيرها من خدمات انطلاقا من سياسة الشركة التي تهدف إلى خدمة العملاء غير مسئولين عن الخسائر نتيجة الاعتماد على المعلومات الواردة، يرجى أن تكونوا على علم تام بشأن مخاطر التداول في الأسواق المالية.

أضف تعليقا