Daily Gold Movement Report – July 23, 2025

Fundamental Analysis:

-

Prices have risen to the 3430 level, which we consider a key resistance area. A profit-taking move is likely around this zone.

-

Our outlook suggests that prices are now moving in line with the rules of the Shanghai Gold Exchange, followed by developments in the COMEX market. Based on this, increased demand in Shanghai is expected to drive global gold prices higher.

-

We maintain our long-term gold price outlook, expecting prices to reach 3700, 3800, and possibly 4000 during the remainder of 2025. These targets are likely to be achieved between September and October.

-

Looking at recent changes in the Shanghai Exchange, we observe the following:

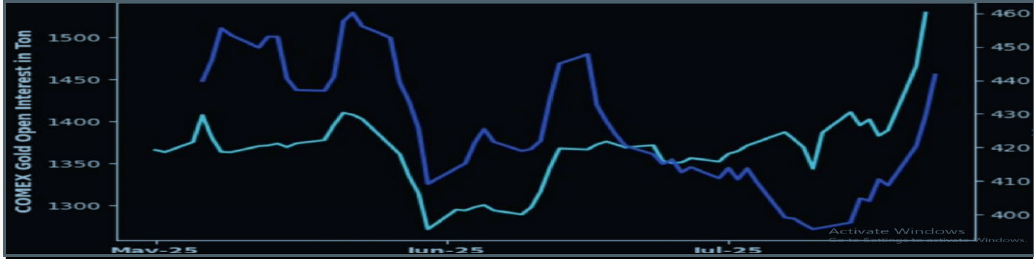

- Execution volume has increased since the beginning of the week by +31 tons, with total demand reaching 442 tons — the highest in five weeks.

- The COMEX gold index recorded its highest level in four months at 492,000 contracts (+177 tons) this month, with total demand reaching 1,529 tons, which may indicate further upcoming price increases.

- Why might the price slow down?

Because swap contracts are set to expire on August 5. These contracts involve the physical delivery of speculative gold positions, so we expect price pressure around that time.

Technical Analysis:

After the upward movement, a profit-taking phase is expected. We anticipate a price pullback to allow contract sellers to deliver physical gold at lower prices.

One of the methods used today was standard deviation, and we found that prices are currently at 2 STB deviation. Typically, when gold reaches these levels, price rejection or a decline occurs—unless there is strong institutional support above. These areas often act as partial exit zones for buyers, so we expect a drop today.

We expect today’s resistance levels to be between 3383 and 3345, followed by a decline back toward the 3400 level. If these levels are broken, we anticipate a move toward 3350.

This outlook would be invalidated if the price closes above 3475.

Disclaimer: We provide all news, opinions, financial data, and other services based on the company’s policy aimed at serving customers. We are not responsible for any losses resulting from reliance on the information provided. Please be fully aware of the risks involved in trading in the financial markets.

Add comment